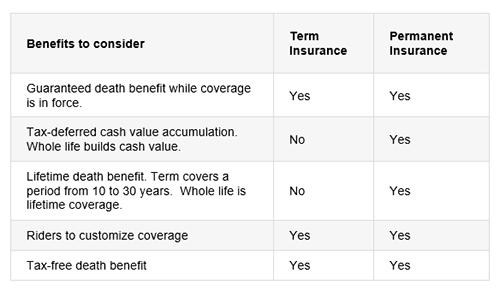

Permanent Whole Life Insurance is the most common type of insurance; it provides you with the certainties of a guaranteed death benefit, cash value and premiums. Have peace of mind with a Permanent plan.

Our PFA Permanent Whole Life Insurance plan gives you the flexibility of five payment options. Issue ages from 0-80. A Term Rider is also available for you to customize your coverage with the combination of lifetime and shorter-term protection needs.

Payment Options for Lifetime (or Permanent) Coverage:

Final Expense Insurance is a type of Permanent Insurance intended to cover funeral costs and end-of-life expenses. This insurance is also known as “burial insurance.” This is a simplified-issue product, where you don’t need to be in perfect health to qualify. The death benefit is guaranteed as long as premiums are paid, and cash value accumulates. PFA’s Final Expense Insurance is available to those ages 50-80 and up to $25,000. A single premium option is also available.

Term Life Insurance is coverage for a certain period of time, spanning from 10 to 30 years. Term Insurance is more affordable than Permanent Insurance. This type of insurance is usually issued for specific reasons, such as paying off debt from a mortgage. Term Life Insurance does not accumulate a cash value.

When the term of your policy expires, you can convert your policy to a Permanent type of coverage or extend the time annually by simply continuing the Term premium payments (that will be recalculated for you annually). Both options are available with no evidence of insurability – meaning if your health were to decline, you still have these choices. Certain limitations apply.

PFA issues a no-cost death benefit of $5,000 to children up until the age of one year, provided PFA National Headquarters is notified within 60 days of the birth of the child. At least one parent must be an eligible Member at the time of the child’s birth to qualify.

Juvenile Term Insurance is a low-cost Life Insurance plan issued for children from ages 0 through 17 that provides protection to age 25. There are no cash values with this plan, but this plan is convertible up to three times the face amount to a permanent plan with no evidence of insurability (up to the age of 25).

Plan Options:

Our permanent plans as described above are also available for children.

The amount of life insurance to buy depends on who you want to protect financially and for how long. For a general idea, consider the following:

Use the Life Insurance Needs Calculator to easily estimate the amount of life insurance coverage you need to take care of your family.

Contact Us

For more information regarding PFA Life Insurance, please contact John Denning at 800-535-2071 or by email at jdenning@polishfalcons.org.